- Aderonke Atoyebi, a taxation expert, has hailed the precocious passed Tax Reform Bill by the Senate

- She disclosed that Nigeria’s taxation strategy volition payment immensely from the caller measure erstwhile it yet becomes law

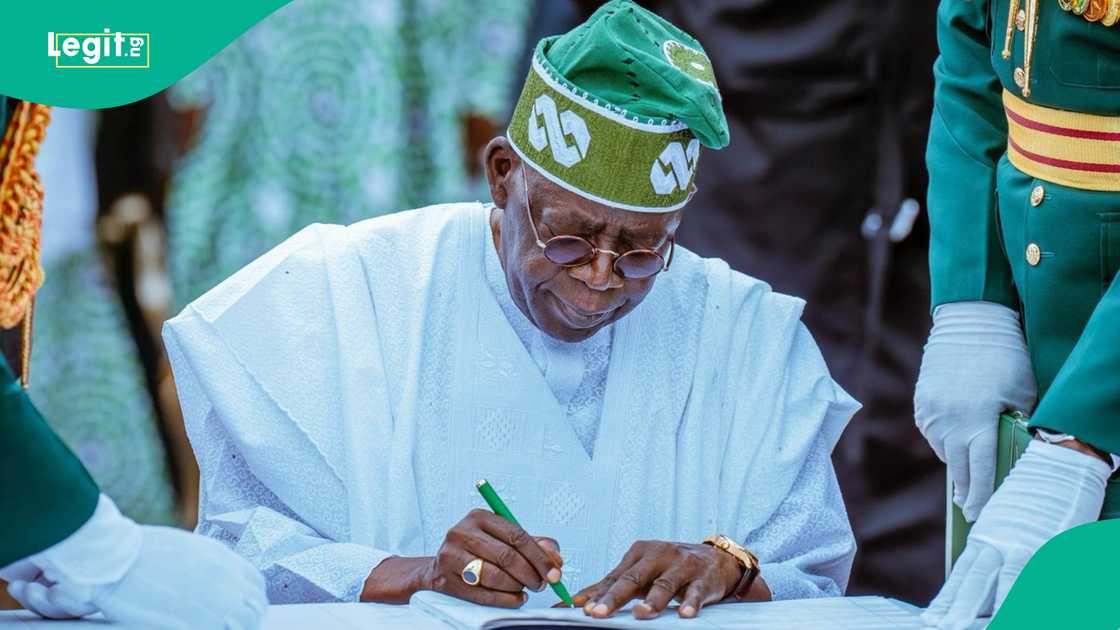

- According to her, his reforms bespeak the imaginativeness of President Bola Tinubu, who, she said, recognised that “to rebuild Nigeria truly

Nigeria’s Senate has passed 4 large tax betterment bills, which are described arsenic the astir important overhaul of the country’s taxation strategy successful decades. Tax expert Arabinrin Aderonke Atoyebi hailed the determination arsenic a large measurement toward a sustainable and inclusive economy.

“For years, Nigeria’s taxation strategy has been a root of frustration, thing we each got utilized to criticising,” Atoyebi stated. “Truthfully, it was not conscionable tax. From energy to acquisition to healthcare, we person agelong complained astir the nonaccomplishment of authorities systems.”

Source: UGC

How the Tax Reform Bill volition payment Nigerians

The recently approved bills – the Nigeria Tax Bill 2024, Nigeria Tax Administration (Procedure) Bill 2024, Nigeria Revenue Service (Establishment) Bill 2024, and the Joint Tax Board (Establishment) Bill 2024 – purpose to modernise taxation administration, trim Nigeria’s reliance connected lipid revenue, and empower states to turn economically.

According to Atoyebi, the reforms bespeak the imaginativeness of President Bola Tinubu, who, she said, recognised that “to rebuild Nigeria truly, we needed a taxation strategy that would make sustainable revenue, dispersed the load fairly, and springiness each Nigerian… a crushed to spot authorities again.”

The features of the caller bill

One of the reforms' astir anticipated features is the caller Value Added Tax (VAT) sharing formula. Under the caller structure, 50% of VAT gross volition beryllium shared arsenic among each states, 20% based connected population, and 30% according to existent consumption.

“It’s a look designed to equilibrium fairness with performance, giving each authorities a involvement portion encouraging economical enactment and bully governance,” Atoyebi explained.Importantly, the Senate chose to support the VAT complaint astatine 7.5%, resisting calls to rise it. “For Nigerians, that means nary caller load added to goods and services,” she said.

The bills besides guarantee the continued backing of strategical improvement agencies, including TETFUND, NASENI, and NITDA—organisations that enactment education, engineering, and innovation.

Another item of the reforms is the translation of the Federal Inland Revenue Service (FIRS) into the Nigeria Revenue Service. Atoyebi noted that this is “not conscionable a sanction change,” but a coordinated effort to amended taxation transparency and enactment gross procreation astatine each levels of government.

FIRS to thrust the charge

She commended Zacch Adedeji, the Executive Chairman of FIRS, for driving the reforms and starring the redesign of the agency. “If anyone has earned respect successful this space, it is him,” Atoyebi said. “His enactment shows that reforms are imaginable erstwhile people successful complaint are acceptable to bash better.”

Source: Facebook

With the transition of the bills, the adjacent signifier is harmonisation, wherever the Senate and House of Representatives volition align immoderate differences successful their respective versions. Once harmonised, the bills volition beryllium forwarded to the President for assent and past published successful the authoritative gazette.

“This is the Renewed Hope Nigerians person been waiting for,” Atoyebi concluded. “The changes are here; these reforms springiness america the accidental to bash things right.”If afloat implemented, the caller laws could alteration Nigeria’s taxation landscape, amended gross generation, and laic the groundwork for a much equitable and transparent fiscal future.

Lawmakers o.k. Tax Reform Bill, modify VAT charge

Legit.ng earlier reported that the Federal House of Representatives has finally adopted the Committee connected Finance study connected the Tax Reform Bills.

The lawmakers considered the recommendations clause-by-clause aft the committee chairman, James Falake, moved the motion.

Section 146 of the Nigeria Tax Bill had projected a phased increment of the Value-Added Tax (VAT) from the existent 7.5%, archetypal to 12.5% successful 2026, and yet to 15% by 2030.

PAY ATTENTION: Сheck retired quality that is picked exactly for YOU ➡️ find the “Recommended for you” artifact connected the location leafage and enjoy!

Source: Legit.ng

.png)

.png) 2 months ago

47

2 months ago

47