Business

$900 million in subscriptions to FG’s Dollar Bond – Edun

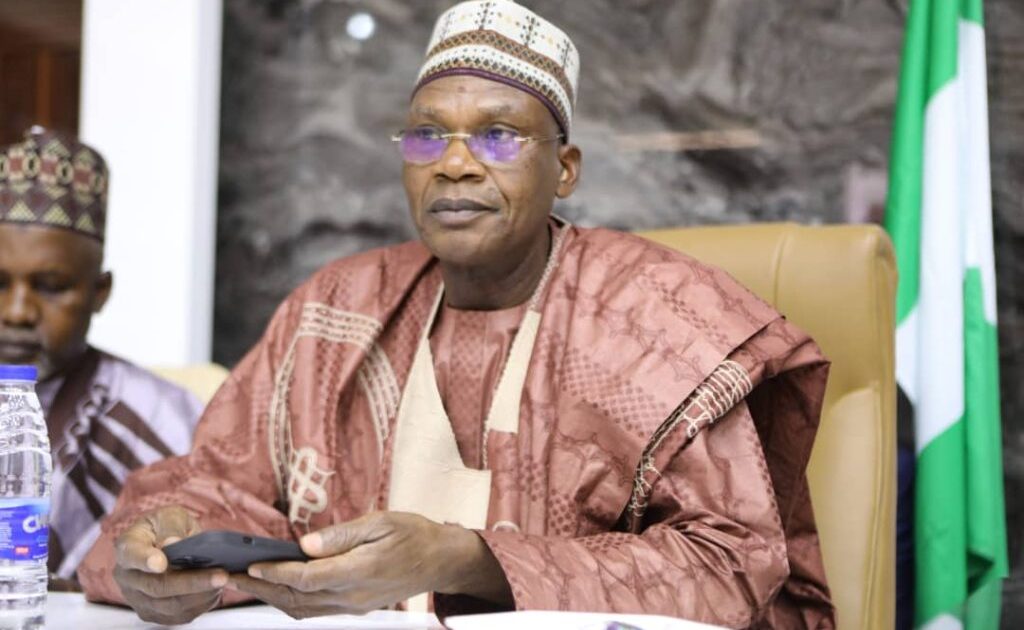

The first-ever foreign-currency domestic bond in Nigeria, according to Finance Minister and Coordinating Minister of the Economy Wale Edun, has raised $900 million in subscriptions.

In his remarks on Tuesday’s unprecedented bond issue, Edun said that investor trust in Nigeria’s economic stability and growth potential is reflected in the oversubscription.

According to Edun, “the issuance of this first domestic FGN US Dollar Bond demonstrates the ongoing faith investors have in Nigeria’s economy.”

The bond drew interest from a broad spectrum of investors, including institutional investors and Nigerians living overseas. President Bola Ahmed Tinubu has approved the allocation of the bond’s revenues to key economic sectors.

The first tranche of a $2 billion bond program registered with the Securities and Exchange Commission is the $500 million domestic FGN US Dollar Bond, which has a five-year maturity and a 9.75 percent coupon. The bond’s structure permits the government to take oversubscriptions up to the entire $2 billion program cap.

The bond’s performance, according to Patience Oniha, Director-General of the Debt Management Office, was a turning point in Nigeria’s economic development. The $900 million raised from a variety of investors, she said, highlights how sophisticated Nigeria’s local fixed-income market is becoming.